Menu

Sensible replaces exuberance in the Nappy Valley housing market in spring 2023. By Anna White, The Telegraph property writer

The UK housing market is reverting to a more normal state after a prolonged period of political and economic uncertainty and the unprecedented disruption of the pandemic. Just as a house settles after an extension or renovation work, property price turbulence has started to subside, especially in the hot south-west London market, also dubbed Nappy Valley.

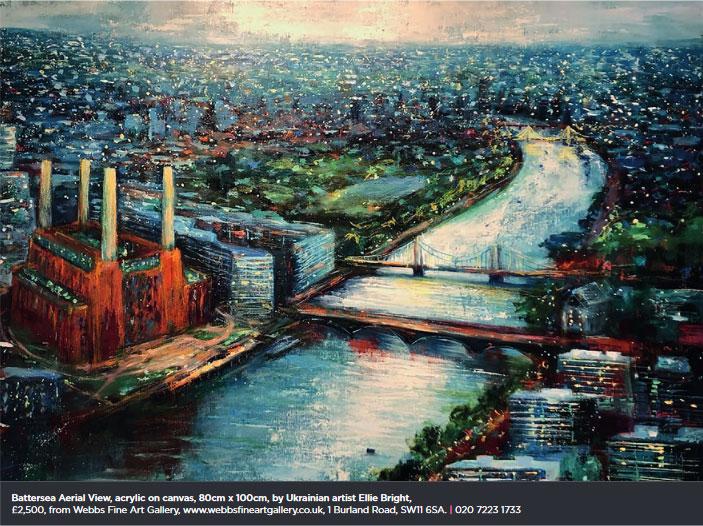

The areas of Battersea, Clapham, Wandsworth, Balham, Tooting, Streatham, Wimbledon and Putney form this leafy district which is considered highly desirable for affluent families who want to stay close to central London and yet settle in a neighbourhood with a village-like feel and swathes of green space.

It is a property market that is typically driven by the changing needs of families, whether it’s the need for another nursery or the need to move into a certain catchment

area. However, over the last eight years it has fluctuated, like the rest of the UK, at the mercy of the referendum, changing Prime Ministers and Covid.

After a prolonged period of malaise and stagnation under the cloud of Brexit, it picked up with the landslide victory of the 2019 general election and the Boris bounce, before being plunged into inactivity when the virus shut down the market for six weeks in the spring of 2020.

Upon reopening, estate agents wrestled with remote and socially distanced viewings while buyers and sellers struggled to navigate the various lockdowns, until Rishi Sunak (then Chancellor) introduced the emergency stamp duty holiday boosting demand and pushing up prices.

While there was well documented movement out of London, there was also a spike in transactions within the south-west as buyers moved over the river from apartments in central locations such as Chelsea and Fulham and into houses with gardens in areas such as Clapham and Balham. The Nappy Valley property market was back in full swing.

For agents such as Patrick Rampton of Rampton Baseley, who specialises in selling homes ‘between the Commons’ (between Clapham Common, Wandsworth Common and Tooting Bec Common) that meant a record financial year 2021-2022 as pent-up demand was released and fed through into sales.

The remote working reality check kicked in and workers started to settle into a more normal weekly rhythm and companies re-established office life. With the threat of a recession looming, ‘presenteeism’ replaced zoom calls.

“THE UK HOUSING MARKET IS REVERTING TO A MORE NORMAL STATE AFTER

A PROLONGED PERIOD OF POLITICAL AND ECONOMIC UNCERTAINTY”

As a result, homes in travel zones 3 and 4 increased in popularity as price, space, commute and convenience became the equation once again.

This is apparent in price growth in the borough of Merton, for example, where values went from an average £500,669 in February 2020 to £573,719 in February 2023 which is an increase of 12pc, the biggest jump of any of the three boroughs in Nappy Valley (Lambeth, Wandsworth and Merton). Most likely this is because as the most peripheral of the three boroughs, areas such as Wimbledon offer bigger plots.

In comparison London-wide prices increased 11pc over the same timeframe to £533,986.

So, all three boroughs saw price rises in this time, when reports would have it that there was a mass exodus from London.

While a desire for more space was the defining trait of 2021–2022, value for money looks to be the defining trait of the 2023 market against a backdrop of fresh economic concerns. Up until 2022 the Bank of England base rate had been under 1 per cent for 13 years, but in an attempt to curb global and domestic inflation and the cost of living,

interest rates had started to go up, taking the cost of a mortgage up too.

The disastrous mini-budget, conceived by the former Prime Minister Liz Truss and her then Chancellor Kwasi Kwarteng promised the biggest tax cuts since 1972 which triggered a domestic financial crisis, a run on the pound and forecasts of spiking interest rates.

At this point Patrick Rampton realised his record year was not going to run into a multi-year spell of revenue growth. “The Christmas break came early in the 2022 housing market following the Trussonomics nightmare as people paused their plans, unsure of how high interest rates would go,” he says. “85 per cent of my customers work in the City and in financial services in some capacity and are well informed and aware of the news, especially around fiscal events such as a budget. There was panic in November as people realised that their mortgages could get really quite expensive,” he adds.

As vendors and agents get ready to launch homes for sale this spring, Rampton says the market is reverting to its pre-Covid levels. “Buyer registrations and stock are down 20

to 30 per cent and I would say things are returning to normal,” he says.

Some of the more toxic quirks of the property market have faded away too, such as gazumping. “We are also only seeing committed buyers, and therefore fewer deals are falling through,” Rampton explains. “The exuberance has gone out of the market, but those people who are buying are very focused.”

Edward McGrane of Marsh & Parsons, covering Battersea and Clapham, believes that in economically challenging times people search for a safe investment and beautiful homes in the best locations. He cites the Nightingale Triangle as one of the most desirable micro-neighbourhoods – these leafy residential roads of Victorian terraced cottages and larger villas touch Wandsworth Common to the west, Clapham Common in the north and down to Balham High Road in the south. Here houses fly off the shelves regardless of the economic backdrop. McGrane also nods to Bramfield Road which cuts across the Northcote Road to Bolingbroke Grove on the edge of Wandsworth Common. It’s on the doorstep of Belleville Primary School, rated outstanding by OFSTED (for 3-to-11 year olds).

Homes on these roads still command sealed bids, he says. “We had a family house on Bramfield Road, priced competitively at £1,695,000 which had 50 viewings, ten offers and went for £1,770,000,” he says. “It’s a fluid market and everyone who is buying and selling is very motivated.”

Austin Thorogood, Director, John Thorogood explains, “The trend towards buying a well-finished property seems set to continue with the risk and uncertainty over building costs and timescales making buyers nervous about taking on unmodernised properties that don’t offer a substantial discount.”

There is some movement as always across Nappy Valley away from the prime locations to areas where your money goes further, such as Streatham. There is a six-bedroom, four-bathroom semi-detached Victorian house for sale on Bolingbroke Grove with views of Wandsworth Common and off-street parking. The immaculately refurbished house has an open-plan

kitchen-diner, illuminated by a series of ceiling lanterns. It covers 4,173 sq ft.

In comparison, on Hoadly Road in Streatham – between Streatham High Street and Tooting Bec Common – is a slightly larger detached property with a wide

garden from the Arts & Crafts era. Again, modernised inside, it has an open-plan kitchen-cum-reception room that opens onto the garden, six bedrooms and four bathrooms but comes with a price tag of £2,995,000. The outstanding (OFSTED) Telferscot Primary School is on the doorstep too.

The prime roads in Streatham include Becmead, which runs from the Lido-end of Tooting Common to the bottom of the High Road, and its parallel avenue Woodbourne. Belltrees Grove to the east of the High Road is popular too with views over Streatham Common. There is a five-bedroom detached house here for sale for £1,695,000 (Rightmove).

As well as Londoners moving across Nappy Valley, rural renters are returning too, according to McGrane. He describeshouseholds who let their home in south-west London during the pandemic, rented in the countryside and have now returned to sell and upsize back in their urban neighbourhood. This is an example of the unravelling of the distorting effects of the pandemic on the property market.

With the Bank of England’s latest rate rise to 4.25 per cent, there is also a flurry of activity from those buyers who want to fix now before their next mortgage deal gets anymore expensive. “As the base rate settles,lenders and borrowers become accustomed toa new era of interest rates, and global inflation starts to ease we expect the busiest part of the year in the housing market to come in the autumn with the second half outperforming the first,” says Ed Lugg, Regional Sales Director, Portico. With more online lenders disrupting the market place and more competition for customers, lenders also may be pushed into releasing more products which are more competitively priced.

Nappy Valley’s estate agents expect the second half of the year to be busier than the first as people acclimatise to the new normal of higher interest rates. This is backed up by Jamie Durham, chief economist at PwC whosays, “One thing is for certain, interest rates over the medium term will be materially higher than those since the global financial crisis of 2008.”

For Patrick Rampton, applying the newly-renovated house analogy rings true for the property market in spring 2023. Although the market is settling after much upheaval there are some cracks appearing, as to be expected.

“Before the end of the stamp duty holiday there was a bun fight by estate agents to get hold of as much stock as possible and as a result there has been a lot of over-pricing. As a result, there has never been such a disparity between asking price and sales price,” he says.

HOME RENOVATING – COSTS & TIMEFRAMES

Based on a typical SW London home circa 160sqm or 1700sqft

- Expect to spend 12-19 per cent of the build value +VAT on professional fees including architects and surveyors. Also 2-4 per cent on insurances/ guarantees

- Loft conversions: subject to existing structure, design and room type. Expect £30-50k +VAT. Timeframe: 10-12 weeks subject to fit out

- Single-storey extension: side return plus rear (30sqm) with a basic finish: Expect £45-60k +VAT. Timeframe: 12-16 weeks

- Basements: Timing dependent on size and access

- Kitchens: Expect £30-80k +VAT. Timeframe: 4-10 weeks depending on bespoke vs kitchen company

- Outdoors: Tiles, grass, decking etc. £10-30k +VAT.

- Fixtures & fittings: Costs variable – the sky’s the limit – budget to refresh furniture

- Put cabling and infrastructure in place for today and tomorrow. £10k +VAT

- Contingency: Allow 5-10 per cent of total budget

- Rent: It’s often better to move out.

Source: Ensoul

The fall in transaction activity is feeding through into the renovations and extensions sector in Nappy Valley. Helen Wood, marketing director at Simply Construction, who has been working across the area for 13 years, confirms that the “rush” she saw over the course of the pandemic has slowed, with fewer people buying homes. “The cost-of-living crisis and higher mortgage rates are having an impact,” Wood says.

However, those people who are unaffected by the dual crises are choosing not to move but to improve, she continues, with extensions, loft conversions and large kitchen projects on the increase.

The pandemic trend to create more outside is here to stay with plenty of requests to build roof terraces into attic conversions. This chimes with the Don’t Move Improve Awards 2022, run by New London Architecture (NLA), which revealed a rise in the number of award-winning projects with the pattern of ceiling beams in the kitchen flowing out into decadent timber verandas in the garden to create al fresco dining areas.

With the cost of glazing going up 30 per cent, bifold doors are still a popular way of letting light into the back of a house and accessing the garden without glazing the whole of the rear wall, Wood explains, with people favouring Crittall-style doors giving an industrial look.

Viki Lander, creative director at Ensoul, believes a focus on wellbeing is influencing decisions inside the home. “Cool greys have been passed over now for warmer, neutral tones of limestone, clay and plaster,” she says. “I think the combination of Covid and the challenging times we find ourselves in, seem to instinctively drive us to softer shades that support wellbeing much more than clinical colours.”

Her clients are choosing to paint whole rooms in bold colours rather than restricting them to just feature walls. “They are embracing dark spaces for cinema rooms and snugs with deep greens, midnight blues, charcoals and even blacks, and then offsetting them with bright luxe upholstery for sofas, armchairs, curtains and art that really pops,” she says.

Lander also pinpoints the need for two home studies, not one. “Even those back to the office are still splitting some of their time between their office and their home. With the omnipresence of video meetings, gone are the days of office sharing at home, each person definitely needs their own closed-off areas.”

Wellbeing is closely aligned with an awareness of climate change and energy efficiency. “It goes without saying that with energy prices soaring there is absolutely a demand for renewable energy in the home. For this we are constantly reviewing and specifying ground source and air source heat pumps and solar panels,” Lander concludes.

There’s a practical sensibility replacing the exuberance of both the Nappy Valley housing and renovations sectors. As we enter the 2023 spring selling season this May, are the roaring twenties turning into a decade of moderate house price rises while homeowners prioritise spend on insulation and energy efficiency?

As Rampton says, referring to Jeremy Hunt’s March Budget, “it was boring but sensible. I rather liked it.”

GETTING A QUOTE

Decided to bite the bullet and do an extension or renovation? Bear these pointers in mind:

- Get three quotes as a minimum, either from recommendations or companies whose work appeals to you

- Meet the contractors in person. Working on your home is a collaboration and the relationship is very important, so find someone you get on with. It could be the difference between a stressful few months and a fun and rewarding process

- Once you have the quotes, visit previous projects undertaken by each team. Look carefully at their tiling, carpentry and paintwork (tip: check corners!). Ideally talk to previous clients and see how they felt about their team during and after the build

- Don’t hang about! Quotes can’t be valid for more than a few months as prices fluctuate.

Source: Bethell Projects